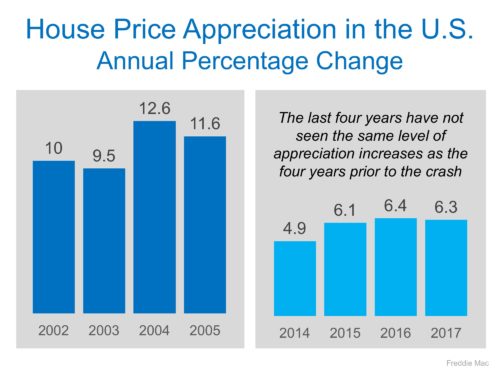

We’ll look at the numbers, as reported by Freddie Mac.

As home values continue to increase at levels greater than historic norms, some are concerned that we are heading for another crash like the one we experienced ten years ago.

What led to the crash had a lot to do with the lenient lending standards, which created false demand. Those “standards” no longer exist.

But what about prices?

Are prices appreciating at the same rate that they were prior to the crash of 2006-2008?

Lets look at the numbers as reported by Freddie Mac:

The levels of appreciation we have experienced over the last four years arent anywhere near the levels that were reached in the four years prior to last decades crash.

We must also realize that, to a degree, the current run-up in prices is the market trying to catch up after a crash that dramatically dropped prices for five years.

Bottom Line

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

What about Seattle?

Talk with your Metropolist broker about our current Seattle market and what prices are looking like in specific neighborhoods. Whether you’re looking at buying a home or listing one, get real talk and real numbers from a professional.

Meet us at Metropolist.